The IRS recently released the 2024 benefit plan limits based on the annual cost-of-living adjustments in the Internal Revenue Code.

These limits take effect beginning January 1, 2024. Employers should update their Summary Plan Descriptions and other materials highlighting the annual dollar limits.

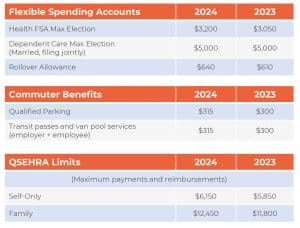

On Nov. 9, 2023, the IRS released Revenue Procedure 2023-34 (Rev. Proc. 23-34), which includes the inflation-adjusted limit for 2024 on employee salary reduction contributions to health flexible spending accounts (FSAs). For plan years beginning in 2024, the adjusted dollar limit on employees’ pre-tax contributions to health FSAs increases to $3,200. This is a $150 increase from the 2023 health FSA limit of $3,050.

The Affordable Care Act (ACA) imposes a dollar limit on employees’ salary reduction contributions to health FSAs. This limit started as $2,500 for plan years beginning on or after Jan. 1, 2013, and has been adjusted for inflation for subsequent plan years. Employers should ensure that their health FSAs will not allow employees to make pre-tax contributions over $3,200 for the 2024 plan year. Employers can impose a lower limit on employees’ pre-tax contributions to a health FSA.

Employers should confirm that their health FSA contribution limit is included in the plan’s documents and communicated to employees at enrollment time.

- The health FSA dollar limit increases to $3,200 for plan years beginning in 2024.

- Employers may impose their own dollar limit on employee salary reduction contributions to health FSAs, up to the ACA’s maximum.

- Employers should communicate their 2024 limit to employees as part of the open enrollment process.

- The limit on health FSA carryovers increases to $640 for plan years beginning in 2024.

2024 Increases

The employee contribution limit for 401(k) plans in 2024 has increased to $23,000, up from $22,500 for 2023. Other key limit increases include the following:

- The employee contribution limit for IRAs is increased to $7,000, up from $6,500.

- The IRA catch‑up contribution limit for individuals aged 50 and over remains unchanged at $1,000 for 2024 (despite this limit now including an annual cost‑of‑living adjustment because of legislation enacted at the end of 2022, referred to as “SECURE 2.0”).

- The employee contribution limit for SIMPLE IRAs and SIMPLE 401(k) plans is increased to $16,000, up from $15,500.

- The limits used to define a “highly compensated employee” and a “key employee” are increased to $155,000 (up from $150,000) and $220,000 (up from $215,000), respectively.

- The annual limit for defined contribution plans (for example, 401(k) plans, profit-sharing plans and money purchase plans) is increased to $69,000, up from $66,000.

- The annual compensation limit (applicable to many retirement plans) is increased to $345,000, up from $330,000.

- The catch-up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), most 457 plans and the federal government’s Thrift Savings Plan remains unchanged at $7,500. Therefore, participants in these plans who are 50 and older can contribute up to $30,500, starting in 2024.

The income ranges for determining eligibility to make deductible contributions to traditional IRAs, contribute to Roth IRAs and claim the Saver’s Credit (also known as the Retirement Savings Contributions Credit) also increased for 2024.

For questions, reach out to your dedicated account manager or contact:

HRPro Accounts 248-543-2644 option 4 accounts@hrpro.com